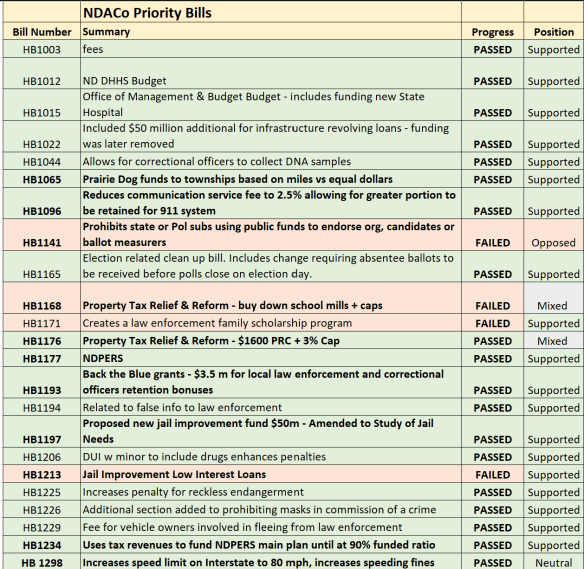

*The following message was sent to ND Legislators in NDACo’s Common Ground. We encourage you to emphasize the importance of Prairie Dog funding for your county with your lawmakers.

The ND Department of Transportation budget is one of the most contentious bills being sorted out in conference committee as the Legislature finishes their work. There are huge differences between the House and Senate versions of SB 2012 regarding funding sources.

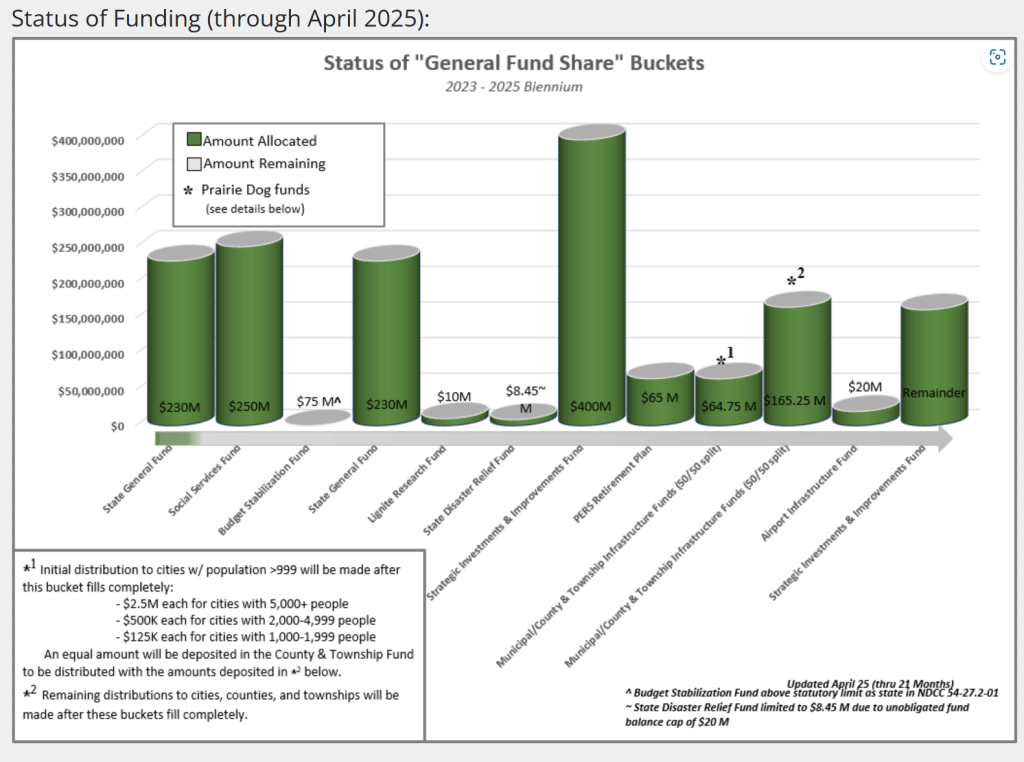

The House version revamps the funding system for local infrastructure which includes eliminating the Municipal, County/Township Infrastructure buckets commonly known as “Prairie Dog” in the state’s oil and gas revenue distribution. Instead, the House proposes to use Strategic Investments and Improvement Fund (SIIF) dollars to go to local infrastructure. This in turn eliminates $230 million in direct distribution dedicated to county, city and township infrastructure, opting instead to provide additional money based on grants from the DOT.

PRAIRIE DOG HAS PROVIDED STABLE AND DEDICATED FUNDING FOR POLITICAL SUBDIVISIONS

The Prairie Dog funding is a dedicated source of funding to counties, cities, and townships for important infrastructure projects. Counties and townships can use the funds for road and bridge projects associated with the construction of new unpaved and paved roads and bridges or associated with the maintenance, repair or replacement of existing unpaved and paved roads and bridges.

While Prairie Dog funds are not certain, and many lawmakers forecast the buckets won’t fully fill this biennium, it’s the fact that when these dollars are provided, they are committed to local government. NDACo continues to support efforts to move the Prairie Dog buckets up to increase the dependability of the buckets filling.

Another appeal of Prairie Dog funds is that they can be banked and used for major projects. This has proven to be an efficient way for local government to tackle large, expensive projects that in the past have been difficult to take on within limited budget authority. The dollars are distributed to counties based on road and bridge infrastructure needs as identified by the Upper Great Plains Transportation Institute.

The House proposal eliminates Prairie Dog funding that was established in 2019. It is one of the buckets created to distribute oil and gas production revenues with non-oil counties, cities and townships. Since inception, Prairie Dog has provided $460 million in funding with distributions being made in 2023 and 2025.

The proposal to eliminate Prairie Dog is a major policy shift that was devised and passed out of the House without a hearing, with no opportunity for input or time for political subdivisions to address concerns with the Appropriations Committee.

GRANTS vs DIRECT DISTRIBUTIONS

Direct distributions provide all political subdivisions monies that can be used for local priority projects as determined by elected officials the voters have approved. Grant dollars, while certainly helpful in many instances, also create uncertainty to the local political subdivision who then have to rely on another entity’s decision on the value of the project. Grants also create additional paperwork for the subdivisions which in many cases the subdivision has neither the time or expertise to handle.

MOTOR VEHICLE EXCISE TAX

NDACo is supportive of the use of Motor Vehicle Excise (MVE) tax for funding roads and bridges. In 2023 the Legislature approved 50% of the MVE tax to be one of the funding sources for the FLEX fund which generated $170 million a biennium. The Senate version of SB 2012 included 100% of the MVE to local infrastructure, while the House version moves 100% of the MVE tax to the General Fund.

GAS TAX

NDACo continues to support gas tax increases that are dedicated exclusively to road infrastructure. Earlier this Session the House passed a $.03 gas tax increase which would be the first increase in 20 years. The Senate proceeded to kill that bill (HB 1382) leaving significant questions about the viability of any gas tax increase. The House’s current plan for the DOT budget includes a $.05 gas tax increase to help cover the loss of Prairie Dog funds, which again inserts uncertainty into local road funding.

AVOID SACRIFICING TRUSTED FUNDING SOURCES

The ND Legislature revised the infrastructure funding plan in the 2023 Session. Counties urge lawmakers to let the current funding model plan work for another biennium. This is especially important with the proposal of a 3% cap on local government’s ability to raise taxes. This budget cap, which seems inevitable, goes into effect this year. This creates a lot of uncertainty with the ability to address funding local needs.

Bottom line: state funding for roads and bridges reduces local property tax dollars required to address needs.

Dependable and dedicated infrastructure funding for local roads and bridges is a top priority for NDACo. We understand this is a difficult time in the process, but we urge lawmakers to keep the funding stream of Prairie Dog intact. While Prairie Dog is uncertain in filling because it is dependent on oil prices and activity, it provides a source of dollars that is dedicated to address local road and bridge needs. We urge lawmakers to SAVE PRAIRIE DOG.